Chapter 28 Breakdown: Mastering Your Burn Rate — Your Financial Oxygen Gauge

Section B3: Money | Start. Scale. Exit. Repeat. Series

Resilience Repurposed Blog by Brent Parker

Intro: You Can’t Grow What You Can’t Sustain

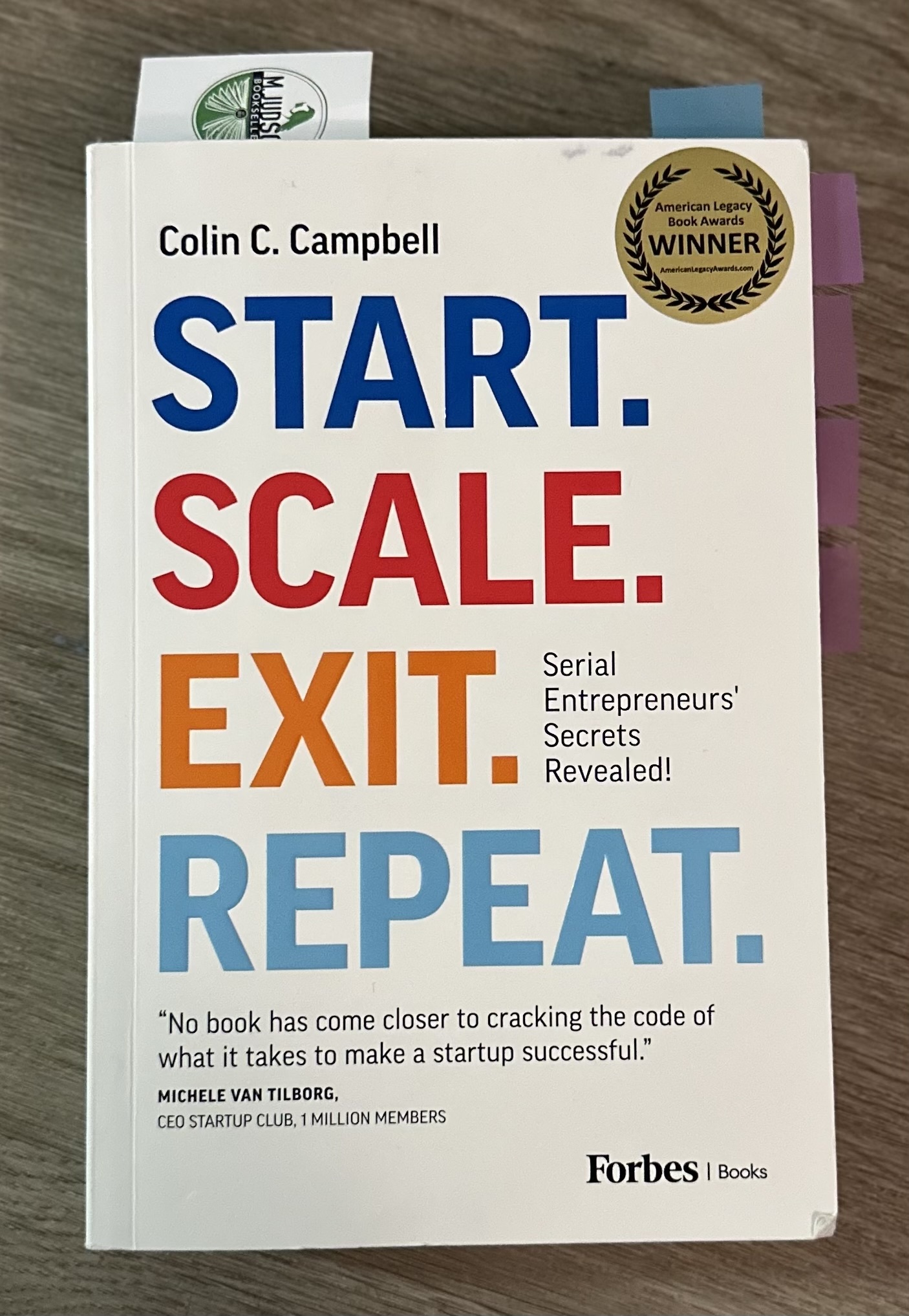

Running out of money isn’t a surprise—it’s a failure to track your burn rate. In Chapter 28 of Start. Scale. Exit. Repeat., Colin Campbell (2023) hammers home one of the most critical startup disciplines: knowing how fast you’re burning cash and how much runway you have left.

This isn’t a panic tactic. It’s survival math.

Your burn rate determines when you’ll need to raise, pivot, or cut. If you’re not watching it weekly, you’re already behind. Campbell doesn’t just teach you how to calculate burn—he shows you how to make decisions around it to keep your business breathing long enough to grow.

🧠 Key Lessons from Chapter 28

✅ 1. Define Your Monthly Burn Clearly

Campbell breaks down the two core types:

- Gross burn = total monthly expenses

- Net burn = expenses minus revenue

You need both, and you need to review them every month. Not knowing your exact numbers is the fastest way to a forced shutdown (Campbell, 2023, p. 208).

✅ 2. Cash Runway = Survival Time

“You should always know your cash runway down to the week.” (Campbell, 2023, p. 209)

To calculate runway:

Cash on hand ÷ Net burn = Months left

This number informs hiring, R&D, marketing—and whether you’re growing smart or fast and reckless.

✅ 3. Know the Difference Between Fixed and Variable Burn

Not all burn is created equal. Fixed costs (rent, salaries, insurance) don’t change easily. Variable costs (ads, freelance help, shipping) can flex. Understanding this difference helps you reduce burn without damaging core operations (Campbell, 2023, p. 210).

✅ 4. Reduce Burn Strategically, Not Emotionally

Founders panic and cut what’s visible—usually marketing or people. But Campbell recommends first assessing:

- What fuels revenue growth?

- What supports customer retention?

- What protects your cash position long term?

Burn reduction should be surgical, not blunt-force (Campbell, 2023, pp. 211–212).

✅ 5. Don’t Burn More Just Because You Raised Money

This is the most brutal truth of the chapter: raising capital can create false confidence. Founders often scale too fast or overhire, assuming more revenue will follow. Campbell warns: always match growth pace with revenue maturity—not investor deposits (2023, p. 213).

💡 Final Takeaway

Burn rate isn’t just a number—it’s a clock. And every tick moves you closer to your next decision point. Mastering burn means extending your timeline, maintaining your control, and earning your right to scale. Track it. Forecast it. Respect it.

🔁 Coming Next

Chapter 29 – Spend Wisely, Spend Boldly

We’ll explore the difference between waste and strategic investment—and why frugality alone won’t make you a founder worth following.

💬 Share This With a Founder on the Edge

Know someone overspending post-funding? Or someone afraid to spend at all? This chapter might be their lifeline—or their wake-up call.

📬 Subscribe to Resilience Repurposed

Get Chapter 29 straight to your inbox. Subscribe here

📚 References

Campbell, C. C. (2023). Start. Scale. Exit. Repeat. Unicorn Publishing.