🪙 Welcome to Chapter 12 of the

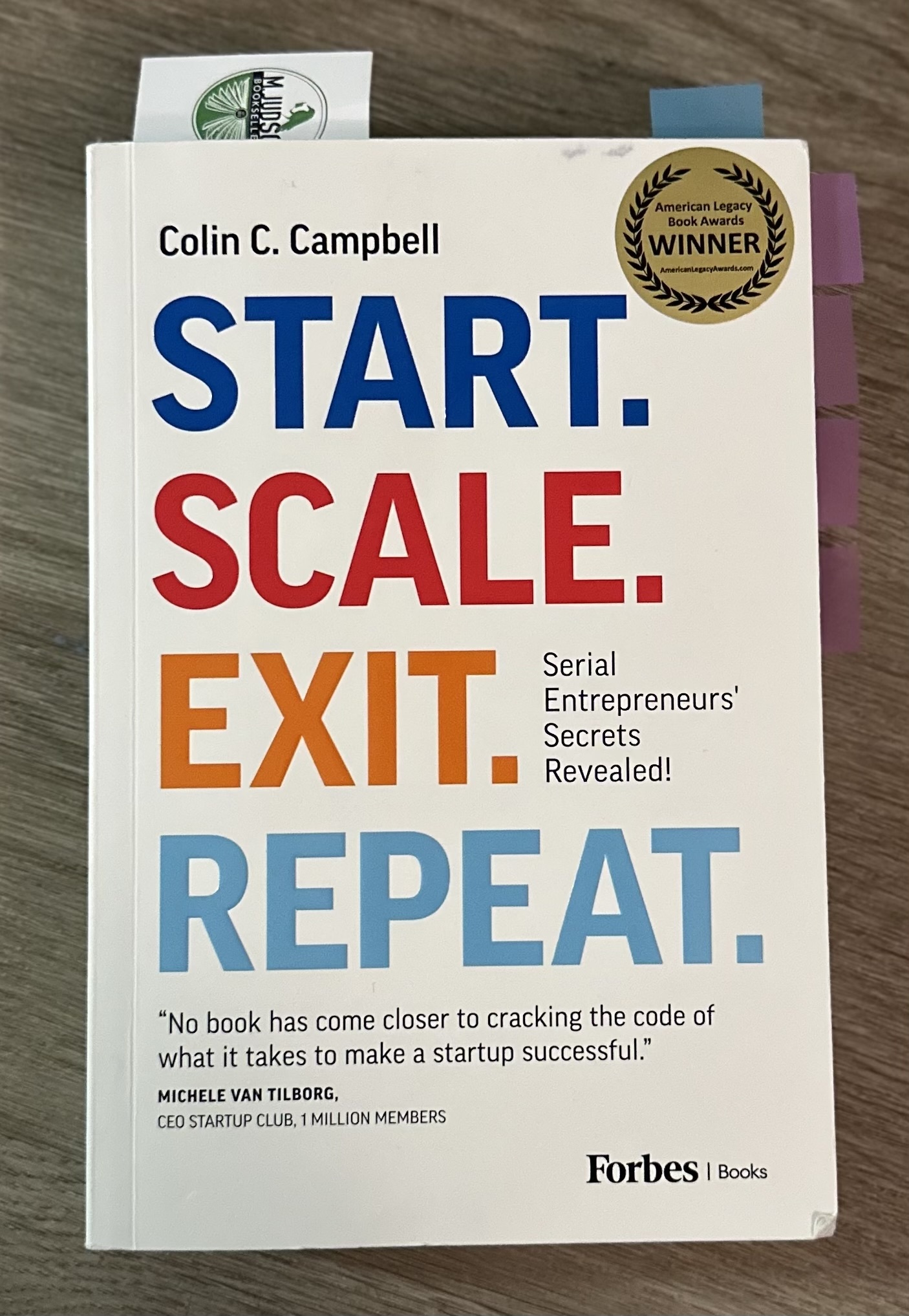

Start. Scale. Exit. Repeat.

Reflections Series

Let’s talk about the part of startups most people avoid: how you actually pay to make it real. Chapter 12 dives into what happens after the spark of a great idea — when you’ve got vision, but no capital. Colin C. Campbell strips away the fantasy of instant funding and shares practical ways to self-fund, bootstrap, and creatively raise early money. If you’ve ever wondered how to fuel your business without burning bridges or equity too soon, this chapter is for you.